What Percentage of Gross Income Is Withheld as an Employees Contribution to Medicare?

Medicare tax is deducted automatically from your paycheck to pay for Medicare Part A, which provides infirmary insurance to seniors and people with disabilities. The total tax corporeality is split between employers and employees, each paying i.45% of the employee's income. High-income earners pay a slightly higher percentage and those who are self-employed pay the revenue enhancement with their quarterly filings.

- What does Medicare tax mean?

- How does it work?

- What is the Medicare tax used for?

- What's the current Medicare tax rate?

- Frequently asked questions

What does Medicare tax mean?

Medicare tax is a federal payroll tax that pays for a portion of Medicare.

Because of the $284 billion paid in Medicare taxes each twelvemonth, almost 63 million seniors and people with disabilities have admission to hospital care, skilled nursing and hospice.

Generally, all U.South.-based workers must pay Medicare tax on their wages. The tax is grouped together under the Federal Insurance Contributions Human activity (FICA). When looking at your paycheck, you may meet the Medicare tax combined with the Social Security tax as a single deduction for FICA.

The Medicare revenue enhancement was established in 1966 to solve a health care problem: For many seniors, income declines and health care needs increase afterwards retirement. But earlier Medicare, the cost of insurance got too high to manage, and some retirees' policies were canceled due to their historic period.

The Medicare program has many components, but a fundamental change at the time was the working population would pay a new Medicare taxation to support Medicare infirmary insurance.

How does it work?

Medicare tax is a two-part tax where you pay a portion every bit an automatic deduction from your paycheck, and your employer pays the other office. The tax is based on "Medicare taxable wages," a adding that uses your gross pay and subtracts pretax health care deductions such as medical insurance, dental, vision or health savings accounts.

Your employer is required to collect the tax, and it sends both the employee and employer version to the IRS through regular electronic deposits.

For example, an individual with an annual bacon of $l,000 would have a 1.45% Medicare tax deducted from their paycheck. That'due south well-nigh $60 each month. The employer would pay an additional $sixty each month on their behalf, totaling $120 contributed to Medicare.

Those who are self-employed pay a Medicare taxation as a role of the cocky-employment tax. Rather than existence deducted from a paycheck, the money is paid through quarterly estimated revenue enhancement payments.

The Medicare tax rate has remained unchanged since 1986. But in 2013, an Additional Medicare Tax for high-income earners was implemented as function of the Affordable Care Act.

What is the Medicare tax used for?

The Medicare tax pays for Medicare Function A, providing wellness insurance for those historic period 65 and older and people with disabilities or certain medical issues. Medicare Part A, besides known as hospital insurance, covers health care costs such as inpatient hospital stays, skilled nursing intendance, hospice and some home health services.

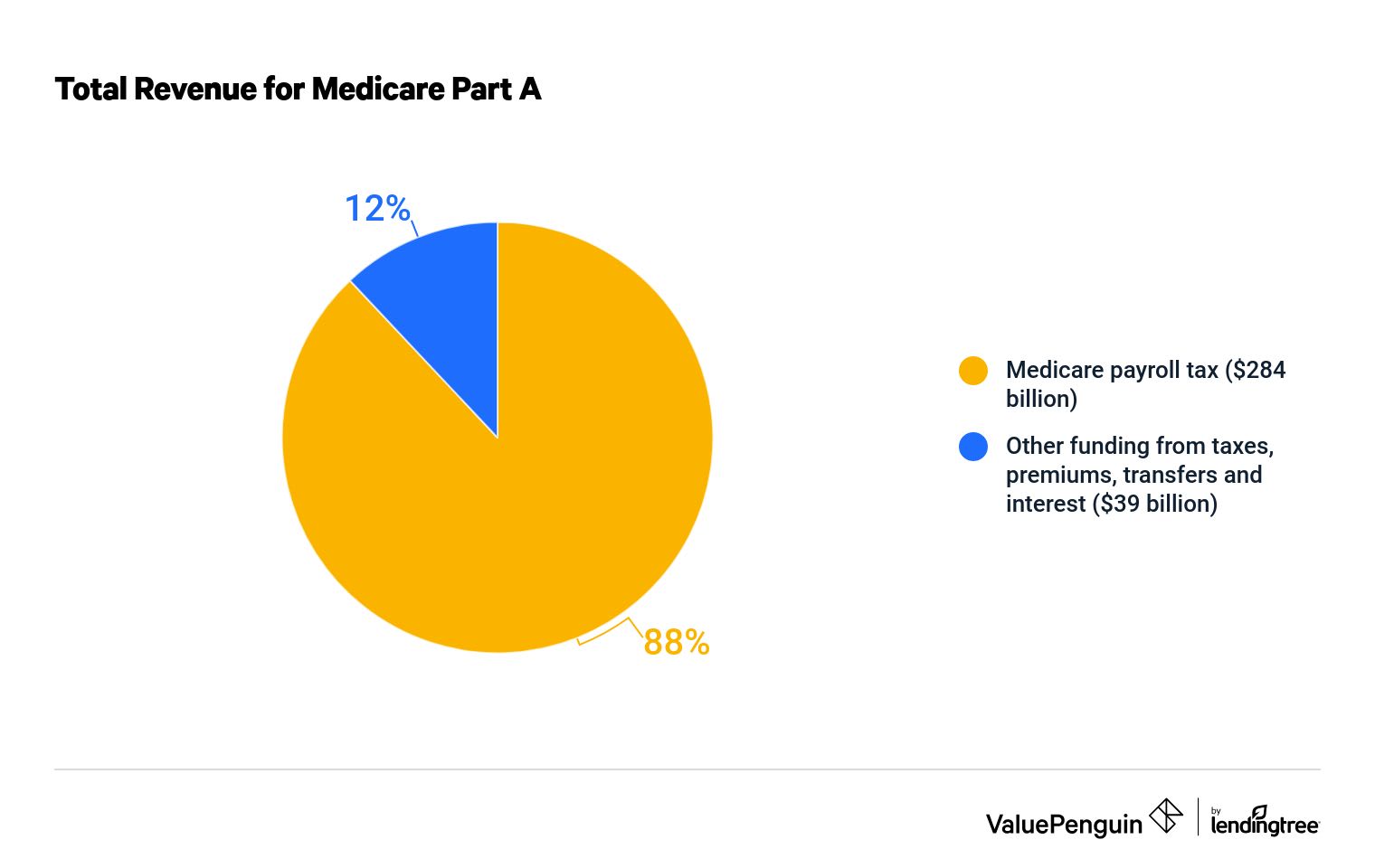

The revenue enhancement nerveless for Medicare accounts for 88% of the total acquirement for Medicare Part A.

Full revenue for Medicare Part A

- Medicare payroll taxation: 88% ($284 billion)

- Other funding from taxes, premiums, transfers and interest: 12% ($39 billion)

All revenue for Medicare Office A goes into the Infirmary Insurance (HI) trust fund, which is slowly being depleted because the expenses for associated wellness services have generally been college than the fund'due south annual revenue. In 2021, the Congressional Budget Office (CBO) projected the trust fund will be fully depleted by 2026.

What is the Additional Medicare Revenue enhancement used for?

Fifty-fifty though it has Medicare in the name, the Boosted Medicare Revenue enhancement paid past high-income earners is used to commencement the costs of the Affordable Intendance Act (ACA), co-ordinate to the IRS. Funds are used for the provisions of the ACA, including providing wellness insurance taxation credits, to make health insurance more affordable for more than 9 million people.

What's the current Medicare revenue enhancement charge per unit?

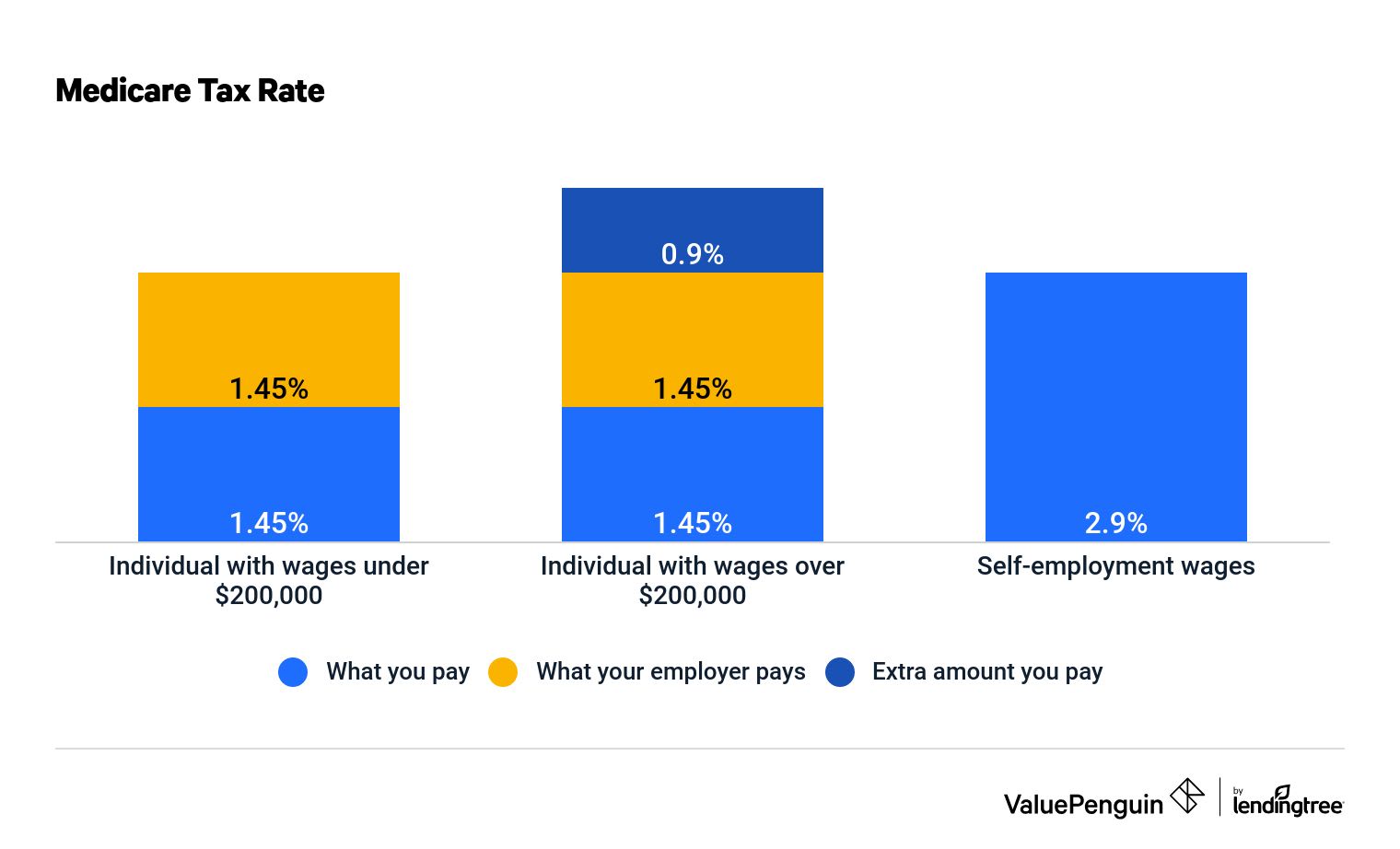

In 2022, the Medicare revenue enhancement charge per unit is 1.45%. This is the amount you'll see come out of your paycheck, and information technology's matched with an boosted 1.45% contribution from your employer for a total of two.9% contributed on your behalf.

| 2022 Medicare revenue enhancement charge per unit | |

|---|---|

| Yous pay | 1.45% |

| Your employer pays | 1.45% |

If you're a loftier-income earner, yous'll pay an Boosted Medicare Tax withholding of 0.9% on any wages that exceed the almanac earnings threshold. In 2022, this threshold is $200,000 for individuals and $250,000 for those who file jointly.

| 2022 Additional Medicare Revenue enhancement for high-income earners | |

|---|---|

| Base rate you pay | 1.45% |

| Boosted amount you pay on income higher up the annual threshold | 0.ix% |

| Your employer pays | 1.45% |

For those who are self-employed, the full 2.9% must be paid past the individual, rather than splitting the tax with an employer. This tax toward Medicare is included in the cocky-employment taxation that is paid quarterly through estimated tax payments.

The self-employment tax corporeality is based on net earnings calculated using IRS form Schedule SE. Even though the tax charge per unit is higher for the self-employed, information technology'due south being paid on a smaller portion of income because the taxable income is 92.35% of net earnings.

For high-income self-employed earners, the Additional Medicare Tax of 0.nine% also applies for any income higher up the annual threshold.

| 2022 Medicare tax for cocky-employed | |

|---|---|

| Charge per unit yous pay on 92% of internet earnings | 2.ix% |

| Additional amount you pay on income higher up the annual threshold | 0.9% |

What wages are discipline to the Medicare tax?

All taxable employment earnings are subject area to Medicare tax. This includes multiple types of income such equally salary, overtime, paid time off, tips and bonuses. In that location is no cap on the amount that's taxed — you may pay Medicare tax on all taxable income. This differs from the Social Security tax, which yous pay only on the starting time $147,000 of your yearly earnings.

Some pretax deductions may exist excluded from Medicare wages, but others are included. Pretax payments for medical insurance or contributions toward a health savings account are non included in the amount that'south taxed. However, Medicare taxation is charged on the funds you lot contribute to a retirement account and premiums paid for life insurance, fifty-fifty though these funds are excluded from your federal income taxes.

Are Medicare taxes charged on investment income?

Aye. If you received investment income last yr, you lot'll be taxed three.8% on either your net investment income or your adjusted gross income (AGI) above the annual maximum, , whichever is less.

Even though the name indicates gain go to Medicare, acquirement from the Unearned Income Medicare Contribution goes into a general fund and is non earmarked for Medicare.

Ofttimes asked questions

What type of revenue enhancement is Medicare?

Medicare taxation is a required employment tax that's automatically deducted from your paycheck. The taxes fund hospital insurance for seniors and people with disabilities.

What is the taxation charge per unit for Social Security and Medicare?

The FICA tax includes the Social Security revenue enhancement rate at six.2% and the Medicare taxation at 1.45% for a total of 7.65% deducted from your paycheck.

What does it mean if you lot meet a Medicare deduction on your paycheck?

If y'all encounter a Medicare deduction on your paycheck, information technology means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital Insurance tax is a required payroll deduction and provides wellness care to seniors and people with disabilities.

What happens if your employer did not withhold Social Security and Medicare taxes?

Employers that exercise not adhere to taxation laws by withholding FICA taxes for Social Security and Medicare could be field of study to criminal and ceremonious sanctions. If you see that no taxes accept been withheld, check with your company to make sure at that place wasn't an mistake or that you didn't merits to be exempt on your W-four form. If y'all underpaid, y'all may have to pay a taxation penalization at the end of the year.

How do cocky-employed people pay Medicare tax?

If you are a cocky-employed person, Medicare revenue enhancement is non withheld from your paycheck. You would typically file estimated taxes quarterly and apply the estimated tax payments to pay your cocky-employment tax including Social Security and Medicare taxes.

What is a Medicare benefit tax statement?

This show of coverage argument confirms that y'all have enrolled in Medicare Part A and accept health insurance that meets the Affordable Intendance Act requirements. Besides chosen a 1095-B, this statement can be used if the IRS asks you to verify your wellness insurance coverage.

Source: https://www.valuepenguin.com/medicare-tax

0 Response to "What Percentage of Gross Income Is Withheld as an Employees Contribution to Medicare?"

Post a Comment